|

Payment Card Industry Data Security Standard (PCI DSS). Organizations that process credit card transactions must comply with Payment Card Industry Data Security Standards (PCI DSS). While organizations are generally able to comply with the requirements therein specified, many struggle with meeting section 10 of PCI DSS. Requirement 10: Track and monitor all access to network resources and cardholder data Under requirement 10, PCI DSS stipulates the secure logging of, and monitoring access to, data networks. This requires organizations to not only ensure logs are complete and kept safe from tampering, but also to proactively review user activity on their data networks. Why is Requirement 10 so difficult to implement? A critical element of this requirement is the need to periodically review access logs and perform proactive network monitoring. Top reasons for difficulty with PCI DSS Requirement 10 include:

DejaVu.

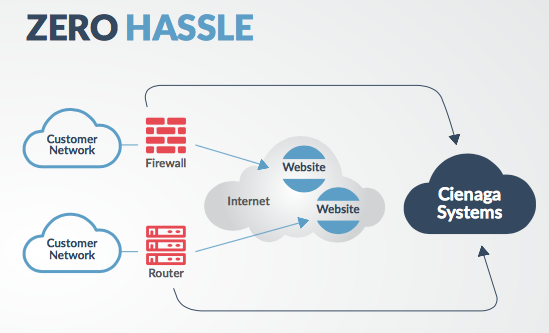

Cienaga Systems' DejaVu is the easiest way for organizations to comply with Requirement 10 in PCI DSS (sections 10.3, 10.4, 10.5, 10.6, 11.4) by providing world-class realtime user behavior monitoring and analytics, remote secure logging and archival. With DejaVu, organizations streamline processes and reduce the need for security analysts by providing autonomous, AI assisted behavioral analysis and reporting. Contact us if you'd like to request a trial. |

About UsThrough the use of Genetically Engineered Cyber Security, Cienaga Systems technologies offer organizations the easiest way to monitor their networks and reduce cyber risk while increasing PCI, HIPAA and regulatory compliance. Archives

September 2017

Categories

All

|

Photos used under Creative Commons from Photo Extremist, Janitors

RSS Feed

RSS Feed